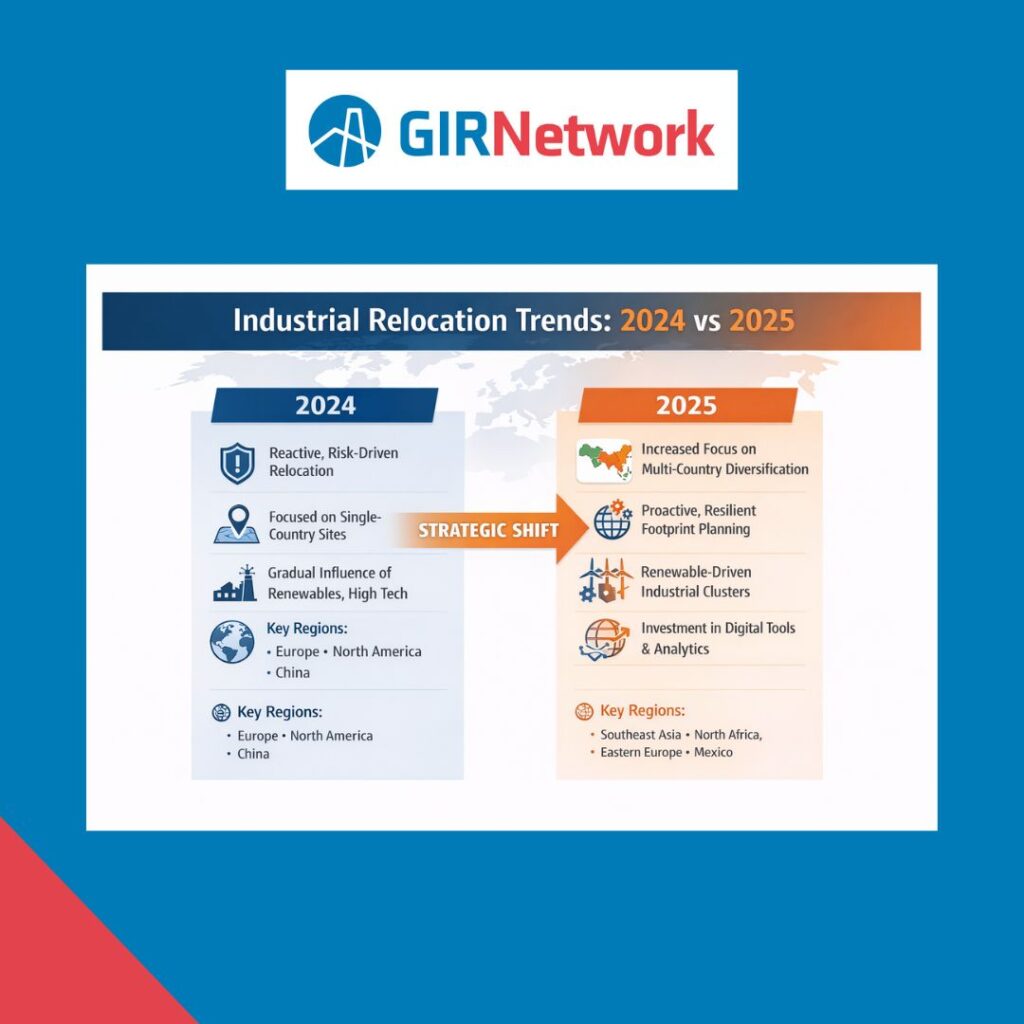

| 🌍 Industrial Relocation in 2025: A Global Shift in Strategy In 2025, industrial relocation has evolved from a reactive measure to a long-term strategic priority. Companies worldwide are redesigning manufacturing footprints to mitigate risk, shorten supply chains, and stay closer to key markets. Rising geopolitical tensions, increased logistics costs, shifting trade policies, and the need for operational resilience are accelerating this transformation. The industry is moving toward regionalization, combining reshoring, nearshoring, and friendshoring rather than relying on a single offshore hub. Nearly 90% of global manufacturers are reviewing or restructuring their supply chains, and forecasts suggest that up to 25% of global trade could be re-regionalized by 2030. 2024 vs 2025 – Trends from the Field: In 2024, relocation was largely reactive, focused on mitigating immediate risks in traditional hubs like Europe, North America, and China. Renewable energy projects and high-tech manufacturing were gradually influencing site selection, but regional diversification was still emerging. In 2025, relocation decisions are proactive and strategic, with an increased focus on multi-country diversification, resilience planning, and renewable-driven industrial clusters. Southeast Asia, North Africa, and parts of Eastern Europe are now emerging as key relocation destinations, while U.S. companies increasingly leverage Mexico as a nearshoring hub to maintain proximity to their markets. Firms are also investing more in digital tools, predictive analytics, and integrated supply-chain planning to manage complex, multi-location operations. Regional Focus: North America: Strong reshoring activity in advanced manufacturing, automotive, and tech; Mexico is a major nearshoring hub. Europe: Reindustrialization is accelerating, with production shifting within the EU and to neighboring regions such as Eastern Europe, Turkey, and North Africa. Southeast Asia: Vietnam, Malaysia, Indonesia, and India attract relocation projects as companies diversify away from single-country dependence. Insider Perspective – Networking is Critical: For professionals in the field, industrial relocation is not just about infrastructure—it’s about ecosystem connectivity. Successful relocation relies on trusted relationships with local authorities, logistics providers, industrial developers, and specialized suppliers. Strong networks enable faster problem-solving, provide early intelligence on regulatory or labor challenges, and help navigate complex cross-border projects. Firms that invest in relationships alongside assets can secure strategic advantages, reduce risk, and accelerate execution in competitive markets. In 2025, industrial relocation is as much about strategic foresight and collaboration as it is about physical location. Companies that integrate digital tools, predictive planning, and robust networks alongside operational investment will be best positioned to build resilient, agile, and competitive supply chains. As 2026 approaches, the key question will be how far this regionalization deepens, and which companies are able to turn today’s strategic relocations into durable, competitive industrial ecosystems for the next phase of global manufacturing. #girn #girn25 #industrialrelocation #industrytrend2025 |